Translation practice is a purposeful activity requiring constant decision making. However, decisions cannot be made without considering the requirements of the job at hand, the client, the governing law, market, recipients, norms, culture, budget and other factors. Looking at the translation industry, we can also trace a broad range of responsibilities and decision making situations which translation service providers and outsourcers are faced with and must handle every day.

When the factors affecting the decision making process increase just like above, it becomes really difficult to take into account and manage all of them in an all-inclusive manner. Without a proper risk management scheme, handling this extensive range of decision making situations and risks and taking into account all issues affecting and resulting from the decisions can turn into a laborious task.

Also, in the current competitive market which more often than not, role players prefer not to share their management plans and experiences with others, it is even harder and more exhaustive for the beginners to survive. They, in fact, have to pass through a long term trial and error to learn how to make proper decisions. This inevitably involves frustration, unexpected failure and profit loss before they can gain some experience to come up with a proper scheme. That is all because, they have not been taught how to deal with decision making situations and risks involved in translation practice and industry during their education. Perhaps it is better to say, there has been no risk management guideline, scheme, or policy in the first place to be incorporated into translator training programs.

It can be claimed that the process of risk management has always been there in translation practice and industry in the sense that translators and project managers in translation companies have always been subconsciously trying to control the risks pertinent to their activities. This is in fact what Pym has been trying to prove by interpreting the results of other researchers’ investigations in terms of risk management (Pym 2007; 2008). However, it is argued here that even if the claim is true, subconscious risk management cannot do more than what we see in the current situation and we need to move from subconscious to conscious risk management to be able to benefit from the risk management process.

The purpose in translation practice and industry is to achieve success in general. Success is, in fact, the “reward” (Pym, 2008) role players achieve when they handle their job properly. Here are some examples of reward: self satisfaction, financial reward in forms of monthly salary, bonus or a raise in the salary, successful communication, avoidance of criticism, getting published, being well received by the society, etc. Therefore, reward can be defined as what the role players in translation practice and industry expect to achieve from doing their activities. It is also worth mentioning that rewards can fall under various categories, three of which have been pointed out by Pym (2008) as financial, symbolic or social. As you can see, success is mostly mutual, meaning that you benefit from your work if your recipients who can be your manager, your client, or the public are satisfied with your work.

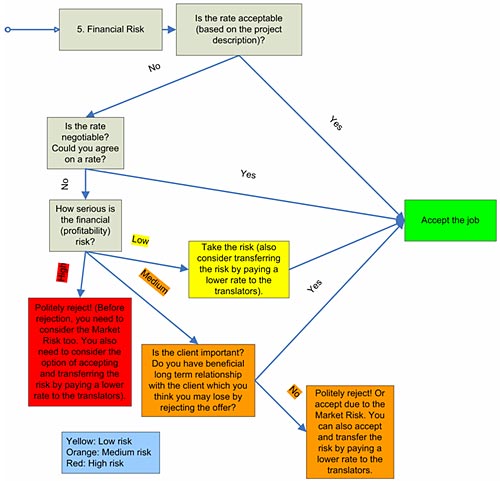

Figure 1 Financial risk management model.

References

Pym, A. 2007.' On Shlesinger’s proposed equalizing universal for interpreting'. In F. Pöchhacker, A. L. Jakobsen, and I. M. Mees. (Eds.) Interpreting Studies and Beyond: A Tribute to Miriam Shlesinger. Copenhagen: Samfundslitteratur Press, pp. 175-19.

Pym, A. 2008. 'On Toury’s laws of how translators translate'. In Pym, A., Schlesinger, M. & Simeoni, D. (Eds.) Beyond descriptive translation studies: Investigations in homage to Gideon Toury. Amsterdam: Benjamins, pp. 311-328.

* * *

Cap comentari:

Publica un comentari a l'entrada